Wait, What? Scholarships Are Taxable?

By Matt Konrad

Up to date February 2024

Everybody is aware of what a scholarship is. It’s free, no-strings-attached cash to assist a scholar pay for his or her greater training.

Proper?

Normally. However not all the time.

In some circumstances, there are vital strings hooked up—together with a number of conditions by which scholarship funds could also be handled as taxable earnings. Whereas it’s uncommon, it’s additionally necessary for each college students and scholarship suppliers to know the way this could occur, and the way it may be prevented.

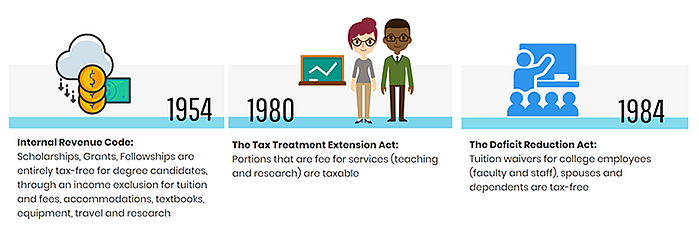

A (Very) Transient Historical past of The Tax Therapy of Scholarships

The tax standing of scholarships was first codified in 1954, and till 1980 it was exceedingly easy: for college kids pursuing a level, all scholarships, fellowships and grants have been tax-free, it doesn’t matter what the funding was used for.

The primary main change to this technique got here in 1980, when the Tax Therapy Extension Act was handed. This modification to the tax code specified that scholarships, grants or fellowships might be taxed in the event that they might be thought of “charges for providers.” In IRS phrases, which means “[money] acquired as funds for instructing, analysis, or different providers required as a situation for receiving the scholarship or fellowship grant.” Exceptions have been later added for instructing and analysis assistantships and for sure federal scholar support applications, however this represented the primary time any earnings associated to scholarships was thought to be taxable.

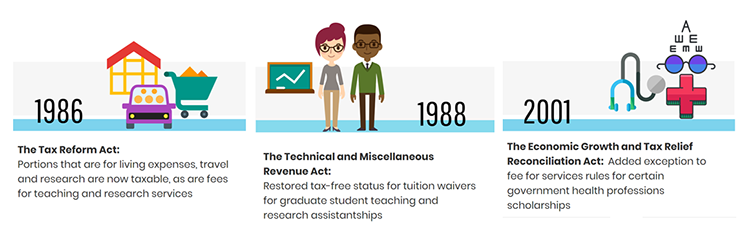

The 1986 Tax Reform Act added considerably extra potential taxation to scholarship and grant funds. For the primary time, the brand new regulation specified that parts of scholarship support used for residing, journey or analysis bills could be handled as taxable earnings. Whereas later amendments eased a few of the tax burden (particularly for graduate scholar academics), this doubtlessly expensive regulation stays on the books right now.

Lastly, present regulation additionally states that scholarships for non-degree-candidates are taxable. As skilled certifications and certificates applications develop into extra well-liked—and even very important, to industries like software program growth and engineering—these legal guidelines put an increasing number of nontraditional college students liable to a heavy tax burden from scholarships.

The Hidden Value of Taxing Scholarships

As outlined by monetary support skilled Mark Kantrowitz on this whitepaper for the Nationwide Scholarship Suppliers Affiliation (NSPA), “There are a number of dangerous penalties of the federal government taxation of scholarships, grants and fellowships.The dangerous impression impacts the power of scholars to finish their training and graduate.Taxing monetary support prevents college students from making full use of their scholarships, fellowships and grants.Scholarships, fellowships and grants are the one type of generosity that’s taxed by the federal authorities.”

These penalties are most stark for the scholar: when extra of their scholarship funds go to taxes, they’ve much less accessible to pay for his or her training. Making issues worse, most federal monetary support calculations are primarily based on the pre-tax worth of the scholarship, which means they danger a shortfall in support once they can least afford it.

There are additionally highly effective drawbacks for scholarship suppliers. As Kantrowitz says, “Non-public scholarship suppliers are reluctant to create new scholarship and fellowship applications and to broaden present applications as a result of taxation makes the applications much less efficient than different charitable functions.” As well as, whereas modern scholarship funders might need to assist college students with the onerous prices of hire, board and transportation, the taxable nature of those funds blunts their impression.

The impression is particularly disproportionate on low-income college students. These from the underside earnings quartile spend, by far, the most important share of household earnings on greater training; virtually half of that cash is spent on the non-tuition prices for which scholarship awards are taxable. (Underneath present regulation, emergency monetary grants may be thought of taxable earnings—and people grants are most important for low-income college students.)

These trying to save cash by attending two-year faculties are additionally more likely to be hit exhausting. In line with The School Board, residing bills for college kids at neighborhood faculties could make up more than 70 % of the fee to attend. Taxing scholarships which might be used for these bills provides an enormous burden to those that can least afford it, even when they’re attending college on a full-ride scholarship or in a tuition-free state.

Restoring Scholarships’ Tax-Free Standing

Whereas taxing scholarship funds might enhance authorities income within the brief time period, it is usually short-sighted. As Kantrowitz explains, “Scholarships, grants and fellowships assist college students graduate from faculty. The federal authorities advantages financially from the elevated federal earnings tax income attributable to greater instructional attainment. So, it’s within the federal authorities’s greatest monetary curiosity to cease displacing scholarships, grants and fellowships by taxation.”

Scholarship America and analyst Mark Kantrowitz have made these 4 suggestions for doing so:

- Make clear that tax-free standing applies to college students pursuing a certificates, not only a diploma

- Make clear that tax-free standing applies to grants, scholarships, fellowships and tuition waivers, in addition to instructing assistantships and analysis assistantships

- Substitute the definition of “certified tuition and associated bills” with a definition of “certified greater training bills,” outlined in relation to whole value of attendance

- Restrict tax-free standing to common college students enrolled at postsecondary establishments which might be eligible for Title IV federal scholar support

These 4 steps will make sure that new types of certification and new fashions of fee aren’t punished for being “nontraditional.” They can even guarantee certified scholarships can be found to pay for the total value of training at eligible faculties and universities—and that may enable scholarships for use, tax-free, to pay for room and board, transportation to and from faculty, and disability- and different college-related bills.

As we work towards this aim, it’s necessary for all training stakeholders to make clear the present state of affairs, and to help monetary support innovation and scholar help.

This put up is predicated on analysis initially offered on the Nationwide Scholarship Suppliers’ Affiliation Convention by Mark Kantrowitz of SavingForCollege.com and Despina Costopolous Emerson of Scholarship America. This put up was up to date Feb. 19, 2024 to replicate new statistics about residing bills.

Supply hyperlink

Benefit-based undergraduate scholarships in engineering

Wait, What? Scholarships Are Taxable?

By Matt Konrad

Up to date February 2024

Everybody is aware of what a scholarship is. It’s free, no-strings-attached cash to assist a scholar pay for his or her greater training.

Proper?

Normally. However not all the time.

In some circumstances, there are vital strings hooked up—together with a number of conditions by which scholarship funds could also be handled as taxable earnings. Whereas it’s uncommon, it’s additionally necessary for each college students and scholarship suppliers to know the way this could occur, and the way it may be prevented.

A (Very) Transient Historical past of The Tax Therapy of Scholarships

The tax standing of scholarships was first codified in 1954, and till 1980 it was exceedingly easy: for college kids pursuing a level, all scholarships, fellowships and grants have been tax-free, it doesn’t matter what the funding was used for.

The primary main change to this technique got here in 1980, when the Tax Therapy Extension Act was handed. This modification to the tax code specified that scholarships, grants or fellowships might be taxed in the event that they might be thought of “charges for providers.” In IRS phrases, which means “[money] acquired as funds for instructing, analysis, or different providers required as a situation for receiving the scholarship or fellowship grant.” Exceptions have been later added for instructing and analysis assistantships and for sure federal scholar support applications, however this represented the primary time any earnings associated to scholarships was thought to be taxable.

The 1986 Tax Reform Act added considerably extra potential taxation to scholarship and grant funds. For the primary time, the brand new regulation specified that parts of scholarship support used for residing, journey or analysis bills could be handled as taxable earnings. Whereas later amendments eased a few of the tax burden (particularly for graduate scholar academics), this doubtlessly expensive regulation stays on the books right now.

Lastly, present regulation additionally states that scholarships for non-degree-candidates are taxable. As skilled certifications and certificates applications develop into extra well-liked—and even very important, to industries like software program growth and engineering—these legal guidelines put an increasing number of nontraditional college students liable to a heavy tax burden from scholarships.

The Hidden Value of Taxing Scholarships

As outlined by monetary support skilled Mark Kantrowitz on this whitepaper for the Nationwide Scholarship Suppliers Affiliation (NSPA), “There are a number of dangerous penalties of the federal government taxation of scholarships, grants and fellowships.The dangerous impression impacts the power of scholars to finish their training and graduate.Taxing monetary support prevents college students from making full use of their scholarships, fellowships and grants.Scholarships, fellowships and grants are the one type of generosity that’s taxed by the federal authorities.”

These penalties are most stark for the scholar: when extra of their scholarship funds go to taxes, they’ve much less accessible to pay for his or her training. Making issues worse, most federal monetary support calculations are primarily based on the pre-tax worth of the scholarship, which means they danger a shortfall in support once they can least afford it.

There are additionally highly effective drawbacks for scholarship suppliers. As Kantrowitz says, “Non-public scholarship suppliers are reluctant to create new scholarship and fellowship applications and to broaden present applications as a result of taxation makes the applications much less efficient than different charitable functions.” As well as, whereas modern scholarship funders might need to assist college students with the onerous prices of hire, board and transportation, the taxable nature of those funds blunts their impression.

The impression is particularly disproportionate on low-income college students. These from the underside earnings quartile spend, by far, the most important share of household earnings on greater training; virtually half of that cash is spent on the non-tuition prices for which scholarship awards are taxable. (Underneath present regulation, emergency monetary grants may be thought of taxable earnings—and people grants are most important for low-income college students.)

These trying to save cash by attending two-year faculties are additionally more likely to be hit exhausting. In line with The School Board, residing bills for college kids at neighborhood faculties could make up more than 70 % of the fee to attend. Taxing scholarships which might be used for these bills provides an enormous burden to those that can least afford it, even when they’re attending college on a full-ride scholarship or in a tuition-free state.

Restoring Scholarships’ Tax-Free Standing

Whereas taxing scholarship funds might enhance authorities income within the brief time period, it is usually short-sighted. As Kantrowitz explains, “Scholarships, grants and fellowships assist college students graduate from faculty. The federal authorities advantages financially from the elevated federal earnings tax income attributable to greater instructional attainment. So, it’s within the federal authorities’s greatest monetary curiosity to cease displacing scholarships, grants and fellowships by taxation.”

Scholarship America and analyst Mark Kantrowitz have made these 4 suggestions for doing so:

- Make clear that tax-free standing applies to college students pursuing a certificates, not only a diploma

- Make clear that tax-free standing applies to grants, scholarships, fellowships and tuition waivers, in addition to instructing assistantships and analysis assistantships

- Substitute the definition of “certified tuition and associated bills” with a definition of “certified greater training bills,” outlined in relation to whole value of attendance

- Restrict tax-free standing to common college students enrolled at postsecondary establishments which might be eligible for Title IV federal scholar support

These 4 steps will make sure that new types of certification and new fashions of fee aren’t punished for being “nontraditional.” They can even guarantee certified scholarships can be found to pay for the total value of training at eligible faculties and universities—and that may enable scholarships for use, tax-free, to pay for room and board, transportation to and from faculty, and disability- and different college-related bills.

As we work towards this aim, it’s necessary for all training stakeholders to make clear the present state of affairs, and to help monetary support innovation and scholar help.

This put up is predicated on analysis initially offered on the Nationwide Scholarship Suppliers’ Affiliation Convention by Mark Kantrowitz of SavingForCollege.com and Despina Costopolous Emerson of Scholarship America. This put up was up to date Feb. 19, 2024 to replicate new statistics about residing bills.

Supply hyperlink

Natural Web site Visitors for Adsense, Adsterra and all Web sites

Impressions for Adx, Adsense and Adsterra

Absolutely funded postgraduate scholarships for worldwide college students

Ladies in STEM scholarship applications 2024

Minority scholar grants for medical college

Environmental science analysis fellowship for graduate college students

Digital advertising scholarships for aspiring entrepreneurs

Neighborhood service management scholarships for highschool seniors

Entry-level software program developer jobs in Vancouver

Distant customer support consultant positions in Toronto

Environmental sustainability challenge supervisor alternatives Calgary

Finance analyst roles in Montreal banking sector

Healthcare administration jobs in Ontario hospitals

Building challenge coordinator positions in Edmonton

Knowledge science internships in Ottawa tech corporations

from Celebrity News – My Blog https://ift.tt/6AnUjby

via IFTTT